Built for Control, Transparency, and Long-Term Value

Our group captive is designed for businesses that are ready to take ownership of their insurance strategy — and finally benefit from strong performance.

Here’s how it works:

What’s Covered

This captive program includes three core lines of commercial insurance:

- Workers’ Compensation

- General Liability

- Auto Liability

If your client is spending $250,000 or more across these lines and has a clean to moderate loss history, this may be a strong fit.

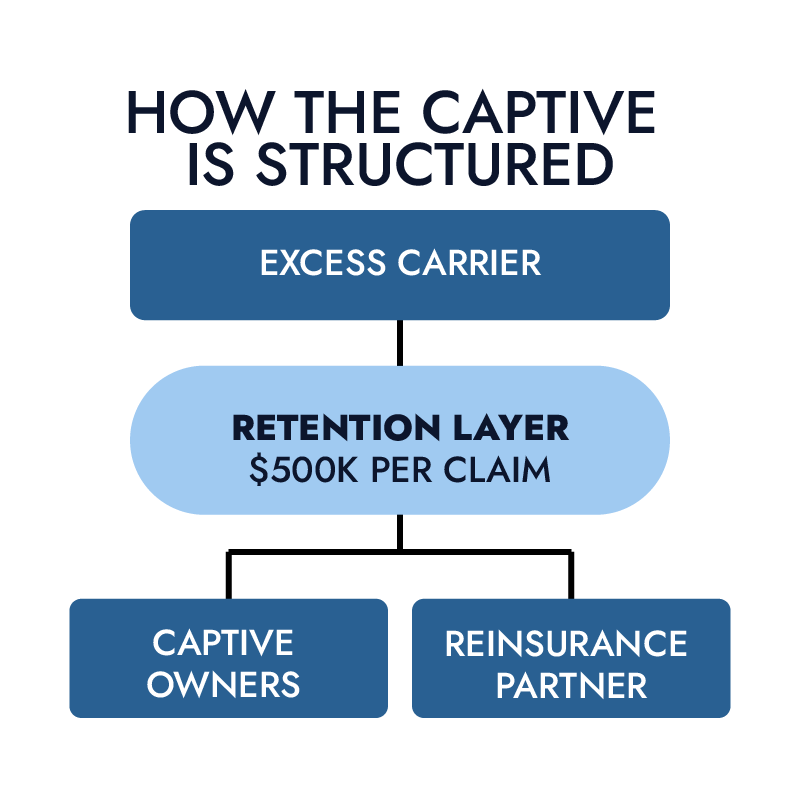

How the Captive Is Structured

This is a true group captive — built with shared accountability, aligned incentives, and a structure that rewards businesses for managing risk well.

- Captive Retention layer: $500,000 per claim

- Quota share model: Claims within the retention layer are split 50/50 with a reinsurance partner

- Excess coverage: Claims above $500,000 are handled by traditional carriers

- Defense costs: Included in the reserve funding — no surprises

Financial Commitment

- Minimum premium: $250,000

- Equity share: $40,000 (one-time ownership buy-in)

- Collateral: Typically 15% of premium and funded via cash or letter of credit

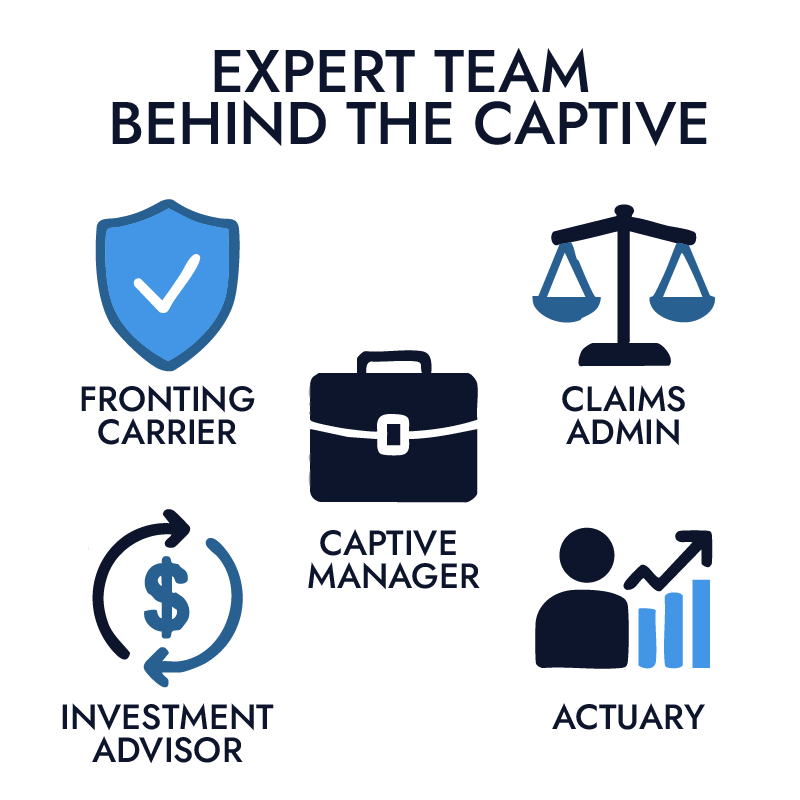

Expert Team Behind the Captive

This captive is built and managed by experienced, best-in-class partners:

- Fronting Carrier: Ascot

- Captive Manager: Captive Coalition

- Claims Administrator (TPA): Sedgwick

- Investment Advisor: Performa

- Actuary: Pinnacle

- Domicile: North Carolina

Excluded Classes of Business

To maintain stability and underwriting integrity, the following industries are excluded:

- Underground Mining

- All Federal Exposures

- Longshore and Harbor Workers

- Explosive Manufacturing

- Petrochemical Operations

Want to know if your client is a fit?

Run the captive calculator or reach out to our team. We’ll help you evaluate the opportunity and guide the next steps with confidence.

Why This Matters

Most independent agents understand what a captive is. But when it comes to explaining how captives actually work financially? That’s where things get a little more complicated.

Quota Share. A/B structure. Risk layers. Premium splits. It’s not just jargon. It’s the part that makes your client either lean in or walk away.

This page breaks it down so you don’t lose the sale at the moment that matters most.

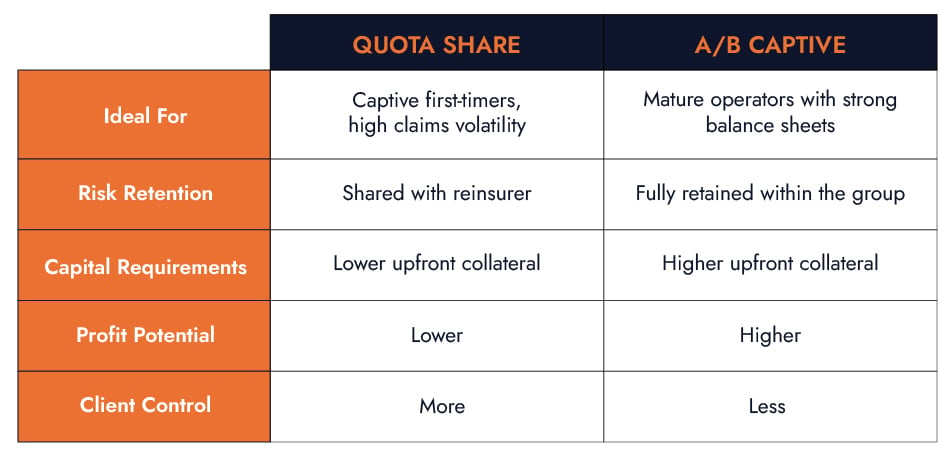

Quota Share vs. A/B Captive

Quota Share Captive

A quota share structure lets your client ease into a captive by splitting the risk and premiums with a reinsurer.

If it's a 50/50 split, the captive keeps 50% of the premium and covers 50% of the risk. The reinsurer takes the other half.

Clients benefit from lower capital requirements and reduced financial exposure.

It’s ideal for businesses new to captives or those with more volatile claims.

A/B Captive

An A/B captive uses two buckets of money: one for small claims (A Fund), one for big claims (B Fund).

The A Fund pays for frequent, lower-cost claims, typically up to $100K–$300K.

The B Fund covers large, unexpected claims, which is anything above the A Fund limit.

If the A Fund runs dry, your client may face additional assessments.

Clients have more control and profit potential, but they take on more responsibility.

Which One Fits Your Client?

Here’s a simplified breakdown to help you match the structure to the right client profile:

What Agents Need to Know

Captive structures shouldn’t be a mystery. Here’s what you need to understand to explain them effectively:

Collateral:

Quota Share = Less upfront. A/B = More skin in the game.

Assessments:

Only a factor with A/B if the frequency fund gets burned through.

Underwriting Profit:

A/B offers higher upside if the client can manage losses.

Client Readiness:

Don’t force-fit a structure. Quota Share is a great ramp. A/B is better for clients already managing risk well.

Say It Simply. Say It Right.

You don’t need to be an actuary. You need to give your client the confidence that this isn’t just another complicated insurance pitch.

We built Captive Coalition to make sure independent agents have real clarity so they can build real trust.

Get Clarity. Get Confident.

What help determining which clients are ready and which structure fits?

Use our Captive Assessment Tool or Talk to a Consultant.