Captive Insurance 101: Helping Clients (with Confidence)

November 14th, 2024

6 min read

Independent agents often hold back from discussing captive insurance because they worry about these two things: they don’t know enough or have the time to learn. Agents know more than they think. Meanwhile, clients grow frustrated with traditional insurance's rising costs and limitations. This can leave you feeling stuck between the wants of your clients and what you might feel prepared to deliver.

At Captive Coalition, our sole purpose is to help independent agents learn more about captive insurers and provide resources to help independent agents thrive. We provide the resources and expertise to make captives easy to know about so you and other independent agents can share the benefits and drawbacks of captive insurers.

This guide will help give you a clear grasp of captives and talking points to share with clients, as well as provide tools to discuss captives as an alternative insurance option confidently.

Helping Clients Understand Captive Insurance vs. Traditional

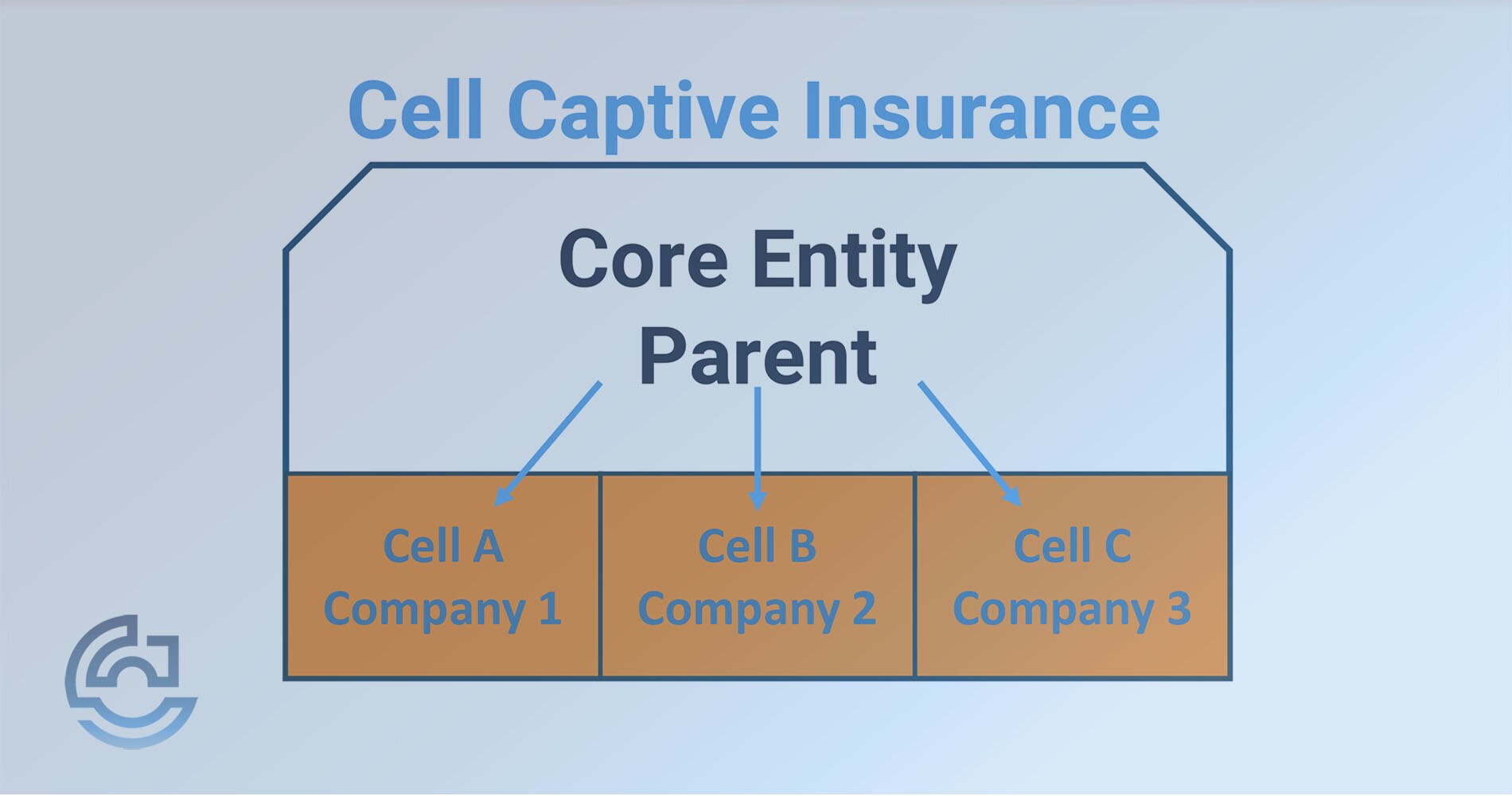

Captive insurance isn’t something every client would be expected to know. The word “captive” can come off as initially intimidating when it’s an insurance model where businesses directly assume and manage their risks by creating (or joining) an insurance entity.

Captive Insurance Basics

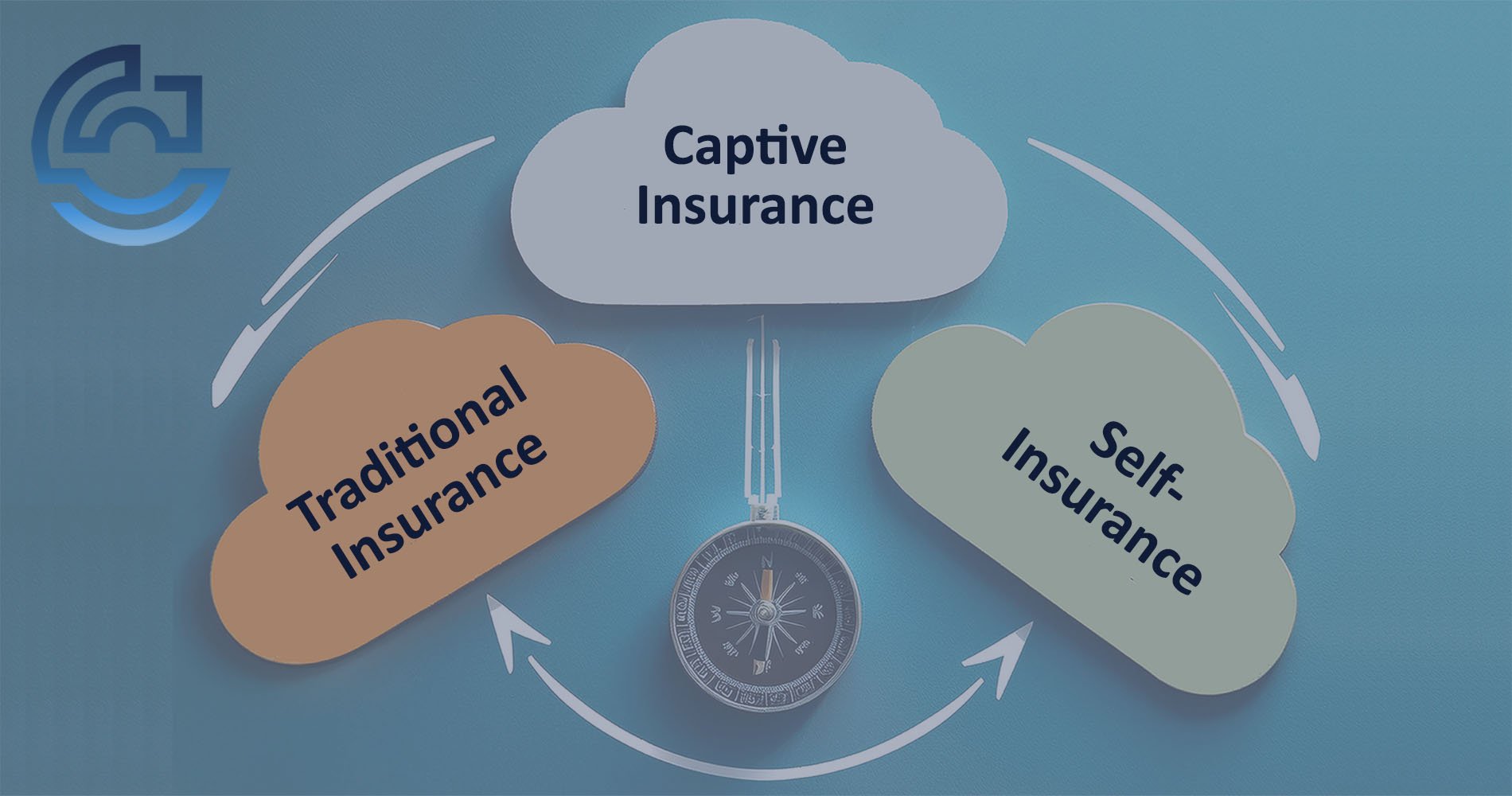

The captive insurance approach contrasts with traditional insurance, where a company pays premiums to a third-party carrier. Captive insurance allows companies more say over their claims, reserve funds, and insurance policies. Rather than following a one-size-fits-all policy, captive insurance is flexible, letting businesses decide how to handle claims, invest premiums, and benefit from cost savings over time.

Differences Between Captive and Traditional Insurance

Captive insurance stands out in three ways:

- Ownership: With captives, businesses retain ownership over their policies and premiums, reinvesting in themselves rather than funding third-party profits.

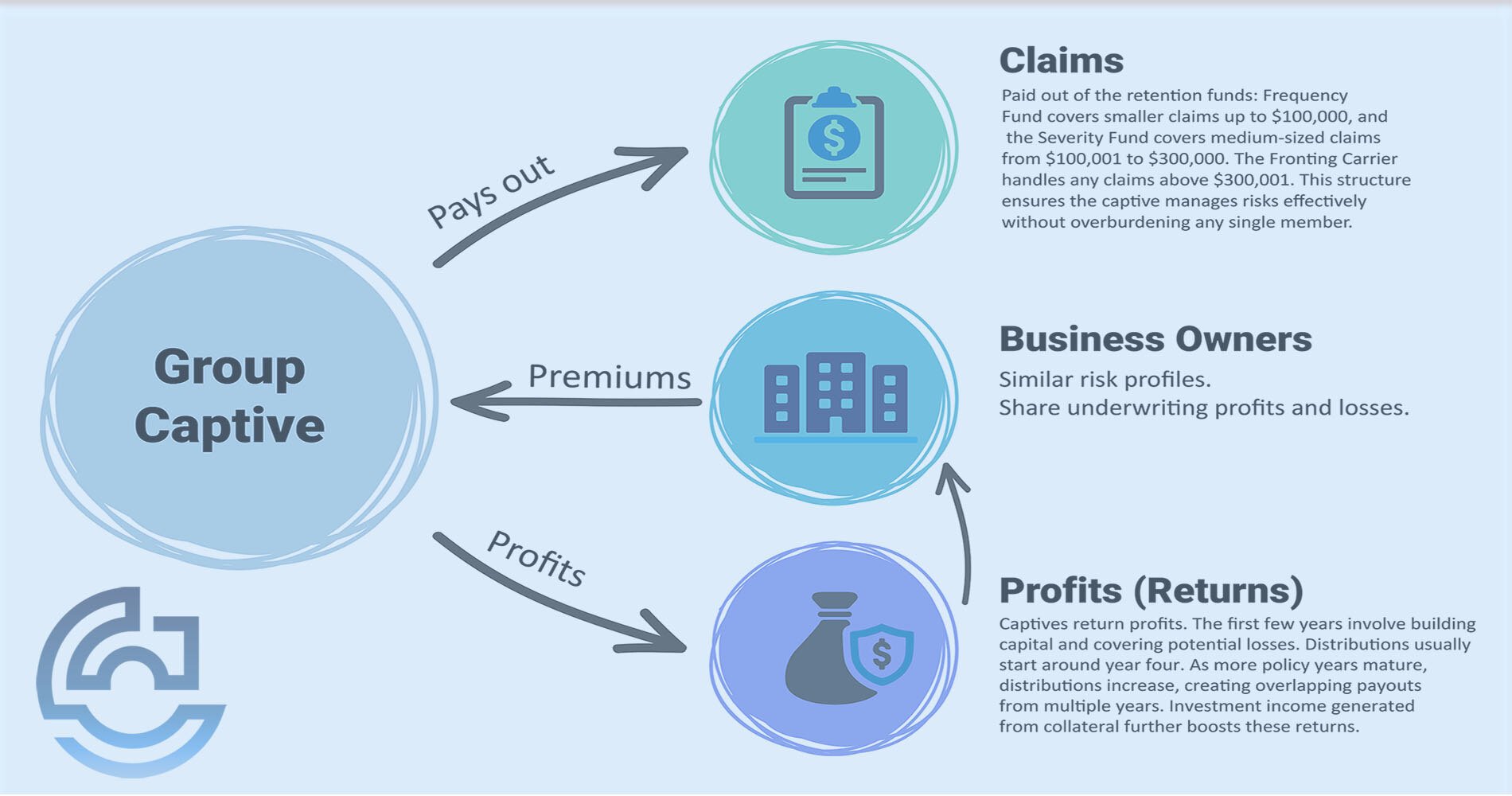

- Profit Retention: Traditional carriers keep any unused premium. Captives return surplus funds to the business owner.

- Customized Risk Management: Captives allow for a high degree of customization in coverage, giving clients more control over exclusions, claims, and policy renewals.

Common Client Misconceptions and How to Address Them

Some of your clients may have heard of captives but have limited knowledge or have heard modern myths about them. Here are some myths and how to address them.

Myth 1: Captive Insurance is Too Risky

Clients might feel that handling their own insurance company is too risky, especially with the fear of financial exposure. This can be countered by explaining that captives provide a structured risk environment with regulated guidelines. Additionally, captives have stop-loss insurance in place to cover major claims, reducing excessive risk while still giving clients control.

Myth 2: Captive Insurance is Only for Large Companies

While captive insurers used to only be viable for large corporations, that is no longer the case. Captives can benefit businesses that meet specific spending thresholds (spend at least $250,000 in premiums annually) and want greater control. Small and mid-sized companies can benefit significantly from captives, including achieving meaningful savings through risk pooling, cost-sharing, and premium retention.

Myth 3: Captives are Overly Complex and Time-Consuming

Clients often assume the captive model is too complicated to manage. Agents can share tools like Captive Coalition’s 101 guide or a cost calculator to show how captives work and how much a client can save. Captive insurance premiums are based on a client’s claims history and how much they enhance their safety and risk management programs. So, the safer their business is, the more savings they can see.

Explaining the Benefits of Captive Insurance for Clients

Businesses that are risk management focused and have low claims can see plenty of benefits while being a captive owner. Here are some benefits they can see:

Transparency in Cost and Claims

One of the primary appeals of captives is financial transparency. Clients know exactly where every cent is being used for their premiums and where their claims are going, and they can influence these areas to suit their long-term goals.

Captives eliminate the traditional premium-versus-loss model that often leaves businesses feeling as though they lack control.

Control and Financial Rewards

With captives, clients have greater authority over how claims are processed and which risks they will retain. This aligns insurance policies with business realities and encourages effective safety and risk management.

For example, clients who actively reduce workplace accidents or loss frequency impact their captive’s financial health and can see reduced costs over time. Captives reward these proactive approaches.

Real-World Impact

Many businesses have reported reductions in premiums by as much as 28% within the first three years of adopting a captive model. By allowing clients to access and control their funds, captives reduce long-term insurance costs and even provide options for profit-sharing based on lower claim volumes and effective risk management.

Challenges of Captive Insurance for Clients

While telling your client all the great things about captives, being transparent about their challenges is essential. Captives don’t work for every business. Here are some challenges your clients need to know.

Higher Initial Costs

Where traditional insurance typically doesn’t have initial costs, captive insurance usually has significant upfront investments, which include fees for risk assessments, audits, and collateral—a line of credit or cash reserve used to secure claims payment. This can be a barrier for some businesses, especially if they aren’t prepared for the setup costs associated with establishing a captive.

Agents should be transparent about these initial expenses while emphasizing the long-term savings that captives can provide.

Long-Term Commitment

Captives are designed to be a long-term finance mechanism, often requiring a commitment of at least five to seven years to see full benefits. This extended timeline may deter clients who prefer more flexibility.

Exiting a captive is possible but requires careful planning, as clients can only access collateral as all policy years close (which can take up to 7 years).

Your clients need to understand the importance of viewing captives as a part of a strategic shift in their insurance approach rather than a short-term fix.

Complexity in Management

Managing a captive can be more involved than traditional insurance, as it requires regular oversight of claims, reserves, and policy adjustments. Some clients may feel overwhelmed by this responsibility.

This can be addressed by offering tools to simplify management tasks, such as automated reporting systems or third-party management options that reduce the administrative load on clients.

Risk Exposure and Loss Variability

Since captives involve self-insurance, businesses take on more direct financial risk, which can be unsettling for some clients used to offloading these risks to traditional carriers.

Agents should be upfront about how captives handle claims and unexpected losses. There are risk mitigation options such as stop-loss insurance, which can reassure clients that measures are in place to cap their potential losses.

Addressing Concerns about Cost and Commitment

Here are some ways you can make your clients feel more reassured about the initial costs and commitment when creating or joining a captive:

Initial Costs and Long-Term Savings

One way to reassure your client is by explaining that initial setup costs are outweighed by long-term premium savings and greater control. Over time, as clients manage their own claims and retain unused premiums, they often see reductions in their total insurance expenses.

Many businesses report a reduction in premiums by up to 28% within the first three years. This can more than offset the upfront costs. This long-term payoff helps clients see captives as a strategic move rather than just another insurance option.

Understanding Commitment Requirements

Agents can help clients understand that captives are best suited for businesses setting a strategic shift rather than a temporary alternative. Explain that captives have a role in reducing insurance dependency, increasing transparency, and building financial stability.

Flexibility in Structuring Costs and Ownership

Captives provide more control, but they also place more responsibility on clients to manage their insurance actively. Emphasize that captives offer flexibility in how claims and risk retention are handled.

Setting Realistic Expectations Around Potential Savings

Clients need to understand their savings hinge on their loss experience. For example, a business with constantly high claims may not realize immediate cost reductions in a captive model. Explain the relationship between claims frequency and captive profitability, emphasizing that better risk management practices are more likely to see financial benefits.

Building Agent Confidence in Captive Insurance

Captive Coalition is committed to making captives accessible and a concept for independent agents to understand. With resources like our 30-Day Quick Start Guide, Captive Assessment, and Captive Pricing Calculator, you’ll have the tools needed to understand and explain the captive model effectively.

For more support, our ready-made “talk tracks” provide scripted responses for essential topics, covering everything from benefits to client benefits.

Tools to make Captive Insurance Discussions Easier

Captive Coalition provides agents with a range of client-friendly tools that make captives easier to present. These include:

- Captive Coalition Learning Center: Our Learning Center has plenty of articles and 101 guides that help walk you and your clients through the basics of captive insurance.

- Cost Calculators: Agents can use calculators to show clients how their current premium compares to a captive model, helping them grasp potential savings. You can use our Captive Insurance Pricing Calculator to estimate the initial investment, potential underwriting profit, and maximum out-of-pocket costs during a high claims year.

- Webinars: Captive Coalition offers webinars for agents and their clients who want to know more about captives.

Spotting Clients Who Might Be Ready For Captive Insurers

Again, not every client will be a fit for captive insurance. Agents should look for clients who:

- Spend $250,000 or more on insurance annually.

- Express frustration with standard insurance models.

- Seek greater control and transparency over claims and premiums.

- Demonstrate a proactive approach to risk management.

Spotting Captive Potential in Client Conversations

Agents can identify good captive candidates by listening to client concerns such as dissatisfaction with rising premiums or lack of policy transparency. With clients who are interested, agents can outline how captives provide the financial and operational benefits they’re seeking.

Are Your Best Clients Fit For Captive Insurers?

Captive insurance can offer independent agents a solution for clients frustrated with traditional insurance’s lack of control and high costs. With plenty of resources, agents will be able to address client concerns and identify the right businesses for captives.

Next, read our article about Identifying Your Best Clients For a Captive Insurer. That way you can understand the indicators in figuring out who your best clients are for captive insurance.

If you have any other questions or want to schedule a consultation, click the button below to speak with one of Captive Coalition’s captive consultants.

Topics: