Topics:

Search for topics or resources

Enter your search below and hit enter or click the search icon.

September 7th, 2024

2 min read

Many independent agents hesitate to discuss captives with their clients, especially when the subject feels complex or unfamiliar. However, captives offer an excellent opportunity to provide more robust insurance solutions that meet clients' needs.

One option to consider for your clients is group captives. At Captive Coalition, we focus on educating independent agents about captive insurance so they can confidently present these options to their clients.

This article will break down the essentials of group captive insurance. By the end, you’ll understand what a group captive is, how it works, and whether it can be the right solution for your clients. We’ll also cover the mindset and financial stability required for businesses to succeed in a group captive, helping you better serve your clients.

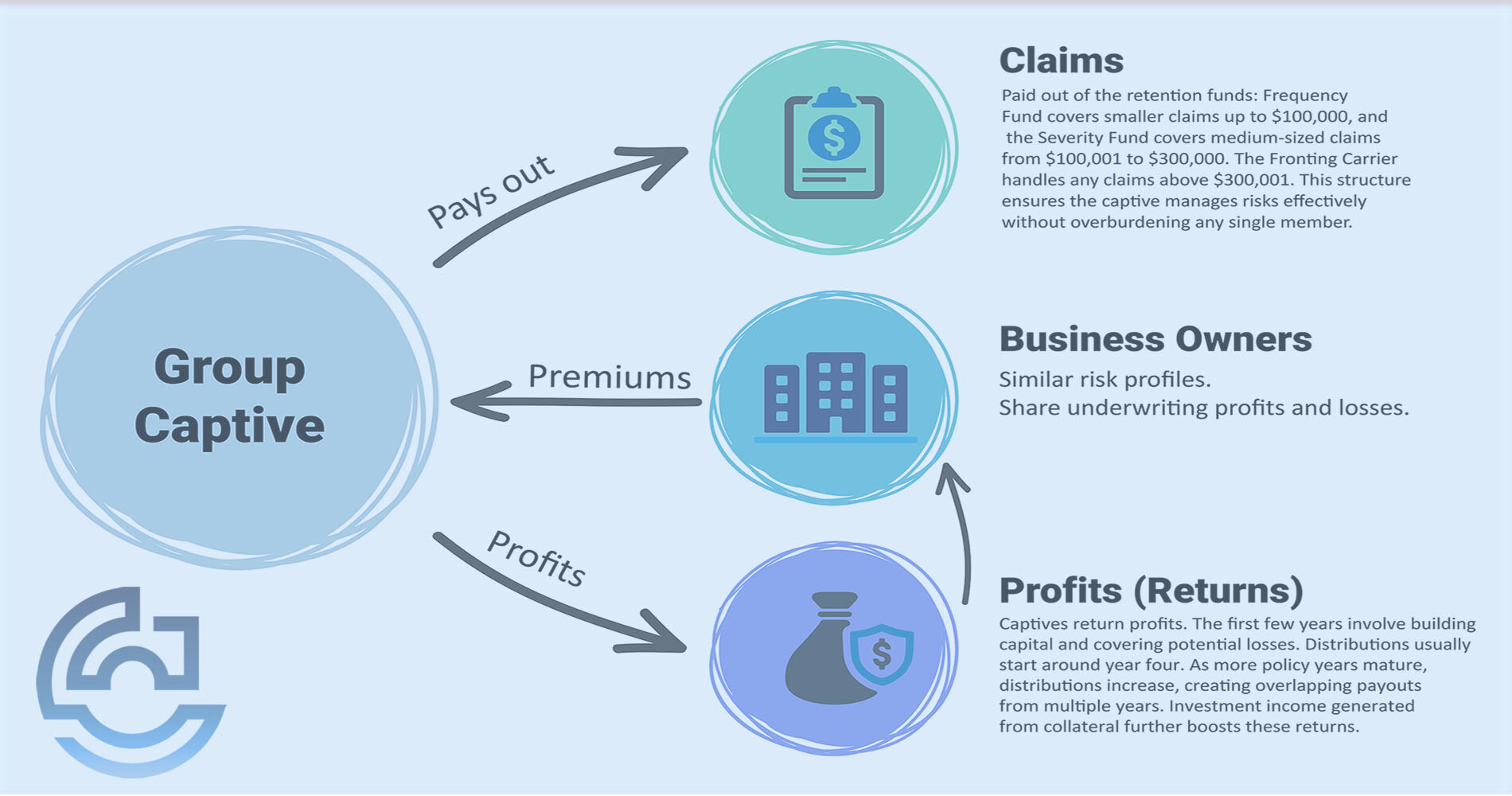

A group captive is a shared insurance venture where similar businesses pool resources to manage and underwrite their risks for control and cost savings. These businesses collectively own and operate the insurance entity, gaining greater control over their insurance costs and improved stability and transparency.

Businesses in a group captive typically share similar risk profiles. By pooling resources, they can secure more favorable insurance terms than they would individually. Here’s why:

Only some businesses are a good fit for a group captive. To determine if your client could thrive in this environment, consider these essential qualities:

You might be wondering if your clients have these qualities. Become a member of Captive Coalition for free to access help, training, webinars, tools, and resources to better help your clients access captives.

While group captives offer many benefits, they aren’t for everyone. It’s important to recognize when a group captive might not be the best fit for a client:

When considering a group captive, focus on these key factors:

Understanding group captives can give you an edge as an independent agent, enabling you to serve your clients better. A well-suited group captive can provide your clients greater control, transparency, and financial stability, particularly in markets where premiums rise despite having no claims.

Next, explore another captive insurance model—Single-Parent Captives. Learn more to see if this model is a good fit for your clients. Later, you can compare the pros and cons of single-parent and group captive insurers.

Still not sure if group captives work for your best clients? Prequalify your clients to see if they're a great fit for them.

Topics: