Financial Benefits and Disadvantages of Captive Insurance

June 20th, 2024

3 min read

If you work with business owners spending high amounts on insurance, you have likely heard frustrations about rising premiums, lack of control, and next to nothing in returns.

Captive insurance offers an alternative approach for qualified businesses to reduce costs, take control, and benefit financially from effective risk management..

As an independent agent, this article will help you explain the financial advantages and disadvantages of captive insurance. That way you and your best clients can determine whether captives are beneficial or a detriment to their business.

The Financial Benefits of Captive Insurance

Solutions that provide transparency, control, and cost-efficiency are valuable for any business. Here's how captive insurance delivers on those priorities to your clients:

- Customized Premiums Based on a Business's Real Risk: Unlike traditional insurers base rates on market averages. Captive premiums are calculated using actual loss history and risk management efforts. Businesses with effective safety practices can see lower, more controllable costs over time.

- The Underwriting Profits Stay With The Business: With a captive, the underwriting profits that an insurance carrier would typically make stay in the captive entity. Well-run captives can reduce renewal premiums by around 28% over 3 years, with a 25% cash flow boost from retained profits.

- Premium Funds Generate Additional Income: Rather than premiums going to an external insurer, those funds remain assets that can be invested and grow, generating extra income streams and asset growth over time.

- Transparency & Control Over Insurance Costs: By assuming select risks directly through your captive, your clients have clear visibility and control over insurance expenditures. Effective risk management reduces claims payouts for real long-term savings.

- Tax-Deductible Premiums, Tax-Deferred Growth: Premiums paid into captives are tax-deductible business expenses. Plus, any underwriting profits and investment income accumulated in the captive are tax-deferred until distributed.

For companies already spending $250K+ annually on commercial insurance premiums, these advantages can lead to significant cost savings and boosted cash flow when done right.

Are you curious to see how your best clients would financially perform with a captive insurer? Use this captive assessment tool to get the results.

The Potential Financial Disadvantages of Captive Insurance

It would be misleading if the potential drawbacks of the captive model weren't drawn out. It's not a magic solution for every company:

- Upfront Capital Investment Required: Establishing a captive requires funded reserves and collateral based on your client's risk exposures. This initial capitalization can be a major barrier.

- Risk of Losing That Invested Capital: If claims exceed projections, the captive's capital may be used to pay them, potentially requiring an additional cash injection to remain operational. This is why proper claims forecasting is important.

- Reinsurance Market Factors: While captives are less exposed overall, volatility in the reinsurance market can still impact pricing and availability of required reinsurance coverage.

- Premium Cash Flow Timing: Captives require consistent premium payments from your client's operating business each year, which impacts short-term cash flow planning.

- "Runoff" Exit Expenses”: If exiting the captive structure, there are expenses to properly run off remaining claims until all policy years can close out in 5-7 years.

- Tax/Accounting Compliance: The IRS enforces strict rules regarding what legally constitutes "insurance" for tax purposes. Failure to meet these rules can create costly tax challenges.

To understand the costs for your client to join a captive insurer, take a look at this video:

Additional Financial Answers Regarding Captives

Here are some additional FAQs about finances regarding captive insurance:

How Can a Business Owner Make Money with a Captive?

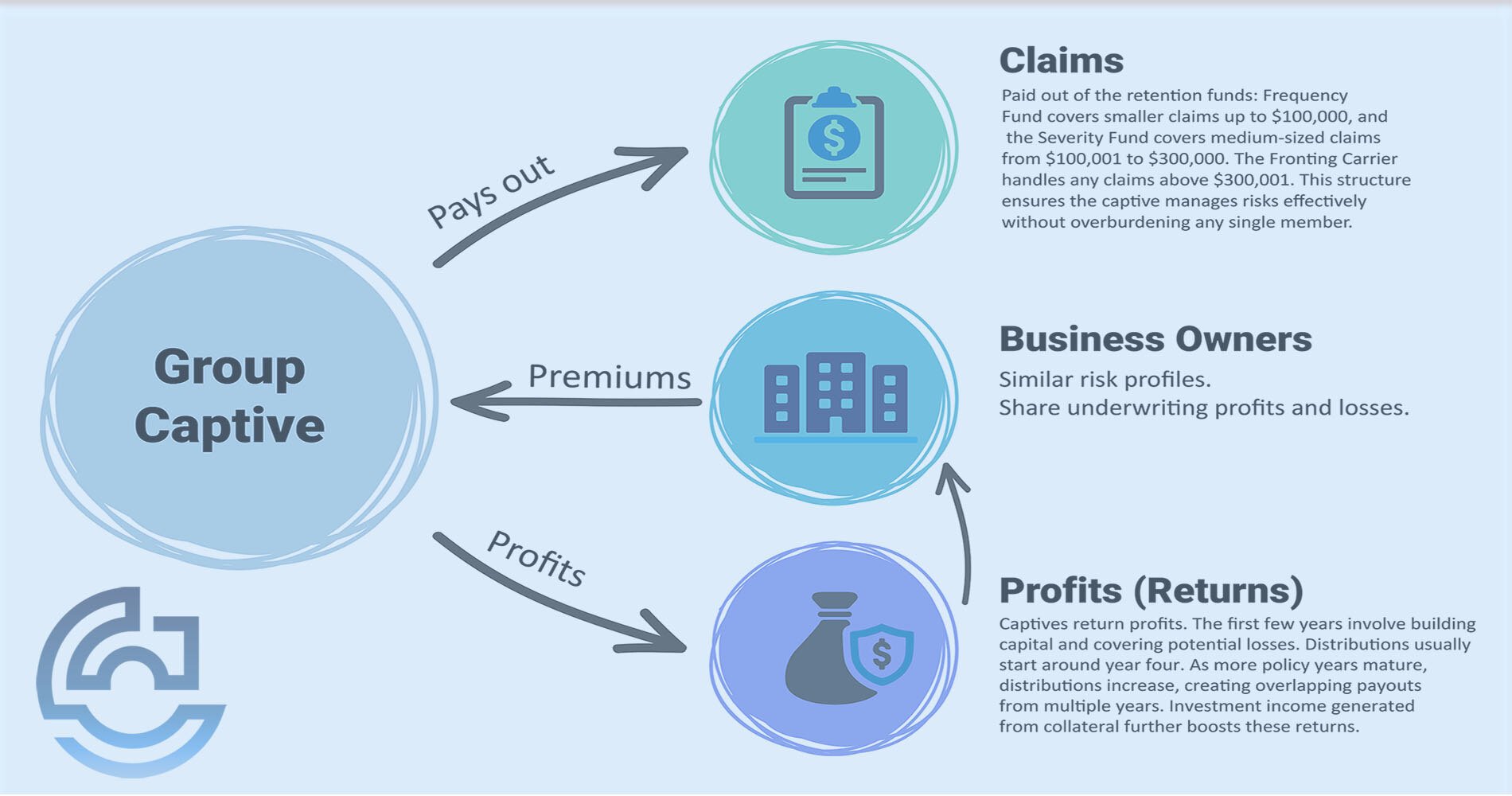

In a captive insurance arrangement, premiums are paid to the captive fund to cover potential losses. Typically, 65% of each dollar is set aside for claims. If your business avoids or minimizes claims, the unused funds are returned to you as distributions. Over time, this can lead to significant savings and even profits. Distributions usually start in the third or fourth year, gradually increasing as more policy years close.

What Are the Costs Involved in Joining a Captive?

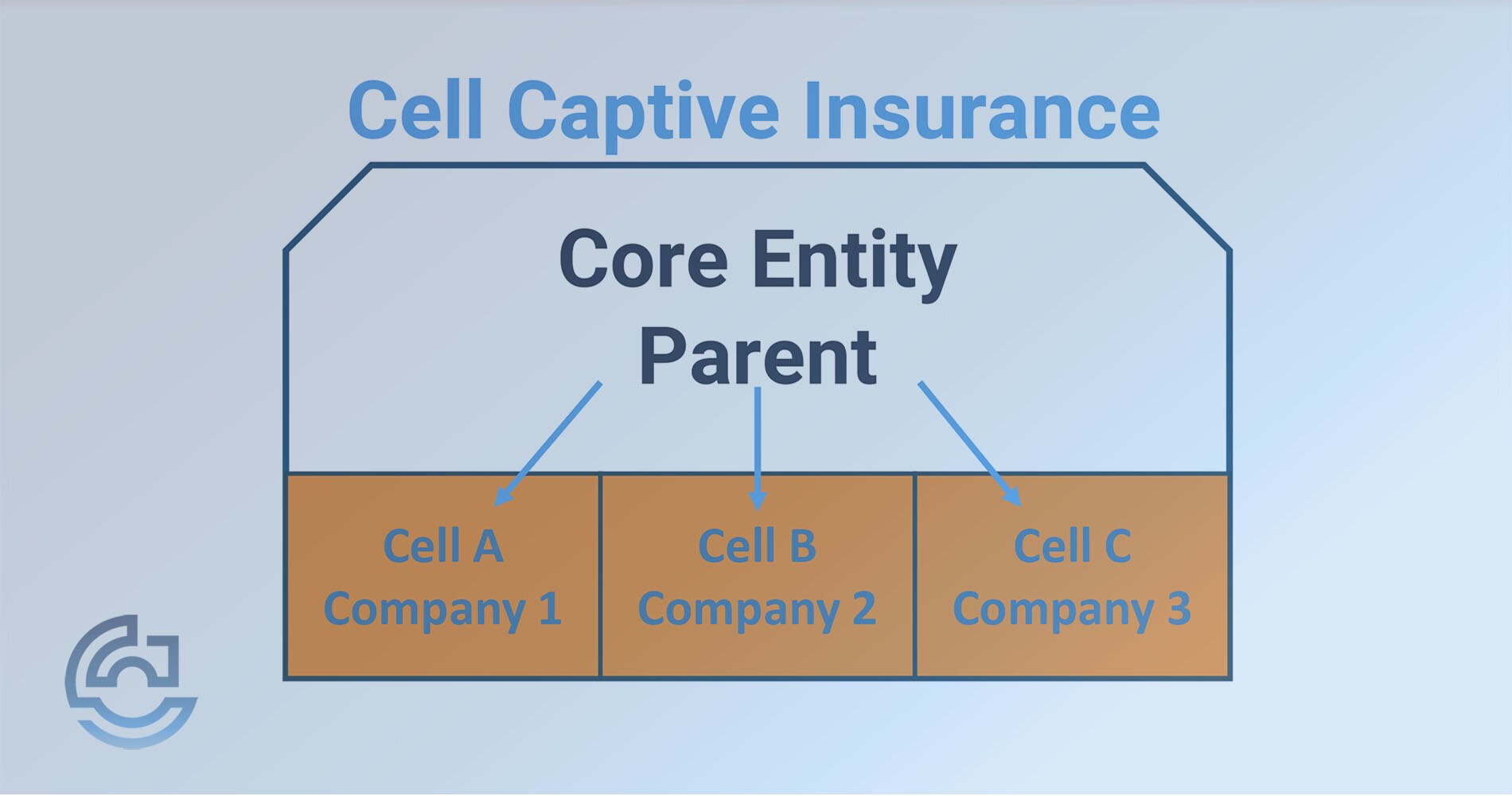

The costs of joining a captive vary based on the type of captive:

- Single-Parent Captive: Typically requires a minimum premium of $1 million for your client to start and own a captive.

- Group Captive: Generally requires a minimum of $250,000 in combined premiums for workers' compensation, general liability, and auto liability. Additional costs include collateral and buying a share to join the captive. These initial premiums are similar to what your client would pay in traditional insurance but offer potential savings in subsequent years.

Can a Big Claim Bankrupt My Client's Business in a Captive?

No, big claims will not bankrupt your client's business in a group captive. Group captives share risks among unrelated entities and often involve a fronting company that covers large claims. For example, if a business faces a $1 million claim, the captive might cover the first $300,000 while the fronting company covers the remainder. This structure ensures that no single business bears the full financial burden of a large claim.

For companies able to make the upfront investment, with strong risk management and claims forecasting abilities, the long-term benefits of captive insurance can outweigh the downsides.

The bottom line? This alternative demands an open, honest evaluation with guidance from captive experts, like the advisors at Captive Coalition. You'll understand the full financial implications of your client's unique situation so you can help them make the right call.

To access tools and to get your best clients into a captive, become a member of Captive Coalition. That way you can access training, webinars, resources, and tools.

Topics: