Topics:

Search for topics or resources

Enter your search below and hit enter or click the search icon.

September 17th, 2024

2 min read

Many independent agents hesitate to discuss captive insurance, especially when it comes to the different structures available. This can lead to missed opportunities for both agents and their clients. At Captive Coalition, we help you confidently understand and present captives, including the cell captive model.

This article will help you understand what cell captives are, their benefits, and their drawbacks. That way you can present them as a potential option for your best clients.

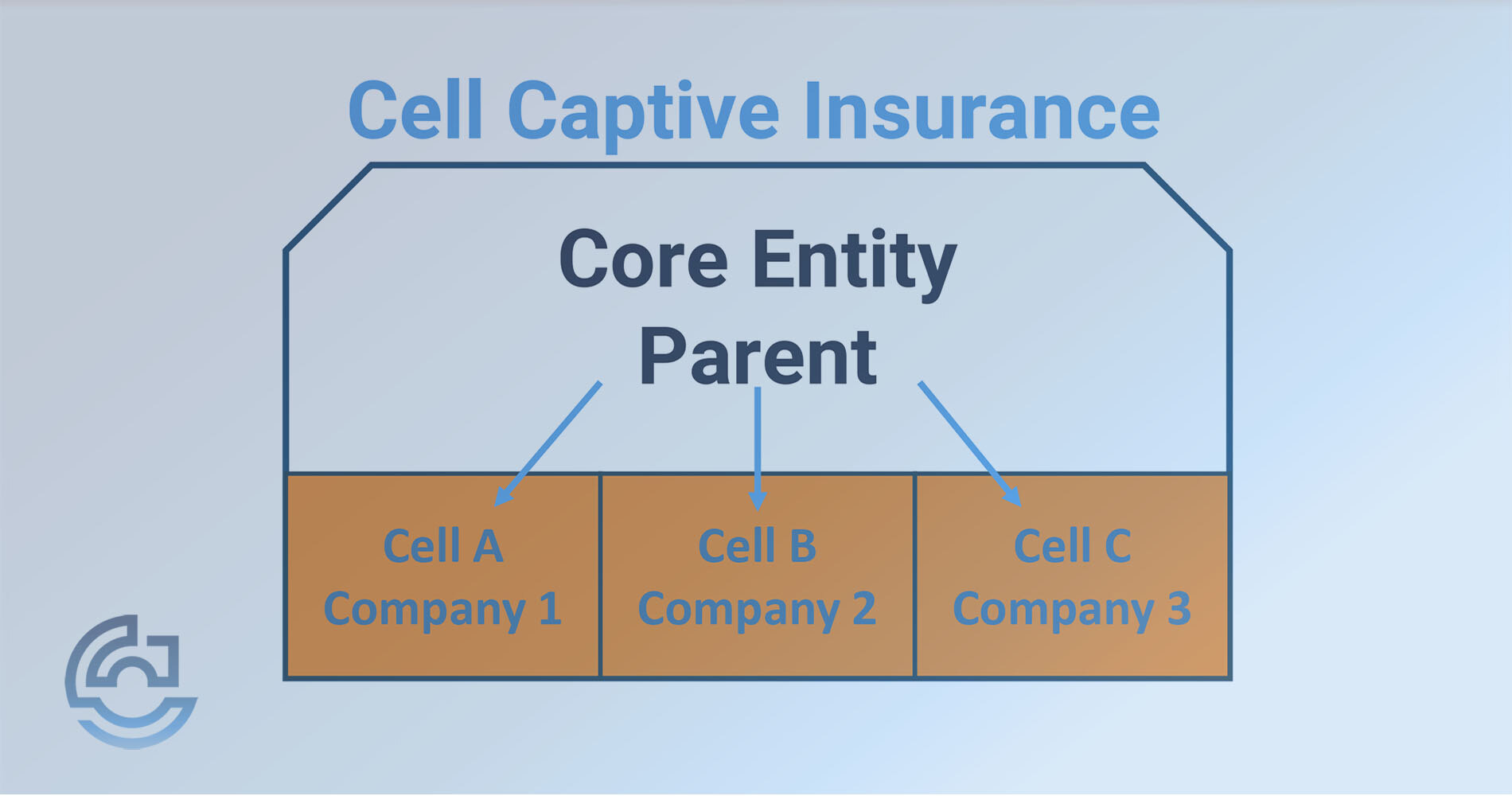

A cell captive is an insurer that allows businesses to share a parent structure while keeping control over their own risks, policies, and finances. This structure allows multiple insureds to share a common framework while also having control over their own distinct financial and risk management strategies.

Each company manages its own risks and policies within its “cell,” and the parent captive handles regulatory compliance.

Think of a cell captive as renting space in a shared building. While each business controls its own “cell,” the parent captive provides the structure, reducing costs and ensuring regulatory oversight. Cell captives allow more autonomy while sharing administrative overhead than group captives, which pools risks.

Your clients can see many benefits in choosing to go with a cell captive for their business.

While your clients can see many potential benefits, cell captives aren't without their drawbacks.

Cell captives are best suited for businesses that:

Cell captives offer businesses a way to gain the benefits of a captive without the full investment of creating one. This model provides a compelling alternative for companies looking to control their insurance by sharing costs, customizing risk coverage, and enjoying regulatory flexibility.

But they’re just one option.

Explore our article on the pros and cons of single-parent and group captives to see which structure best fits your client's needs.

Do you think captives are right for your clients? Become a member of Captive Coalition for free. to access our tools, resources, webinars, training, and opportunities to help your best clients.

Topics: