What is a Single-Parent Captive? A Guide for Independent Agents

August 6th, 2024

3 min read

Even with some of the most experienced agents, understanding captive insurance is a difficult concept to initially comprehend. It doesn’t help there are multiple types of captives.

Thankfully, Captive Coalition is all about understanding captive insurance, educating independent agents, and helping readers like you understand all aspects of captives.

As an agent or business owner, this article will help you understand single-parent captives, how they operate, how they’re different from group captives, their benefits, and their drawbacks.

What is a Single-Parent Captive?

A single-parent captive, also known as a “pure” captive, is an insurance entity created and owned by a business—referred to as the “parent” company—to insure its own risks. They’re designed to meet the needs of the parent company. Compare this to group captive insurers, which pool risks from multiple businesses

This structure provides the parent company with complete control over its insurance programs, ensuring that coverage and risk management strategies align with the company's specific operational requirements.

Before continuing, you might wonder if your client would be a good fit for a captive, regardless of joining a group or creating a single-parent captive. Take the captive assessment to get your results.

Differences between single-parent and group captive insurers

Both serve as alternatives to traditional insurance, though they have different structures and benefits.

- Single-Parent Captives—These are wholly owned and operated by one business, providing complete control and customization of the insurance program.

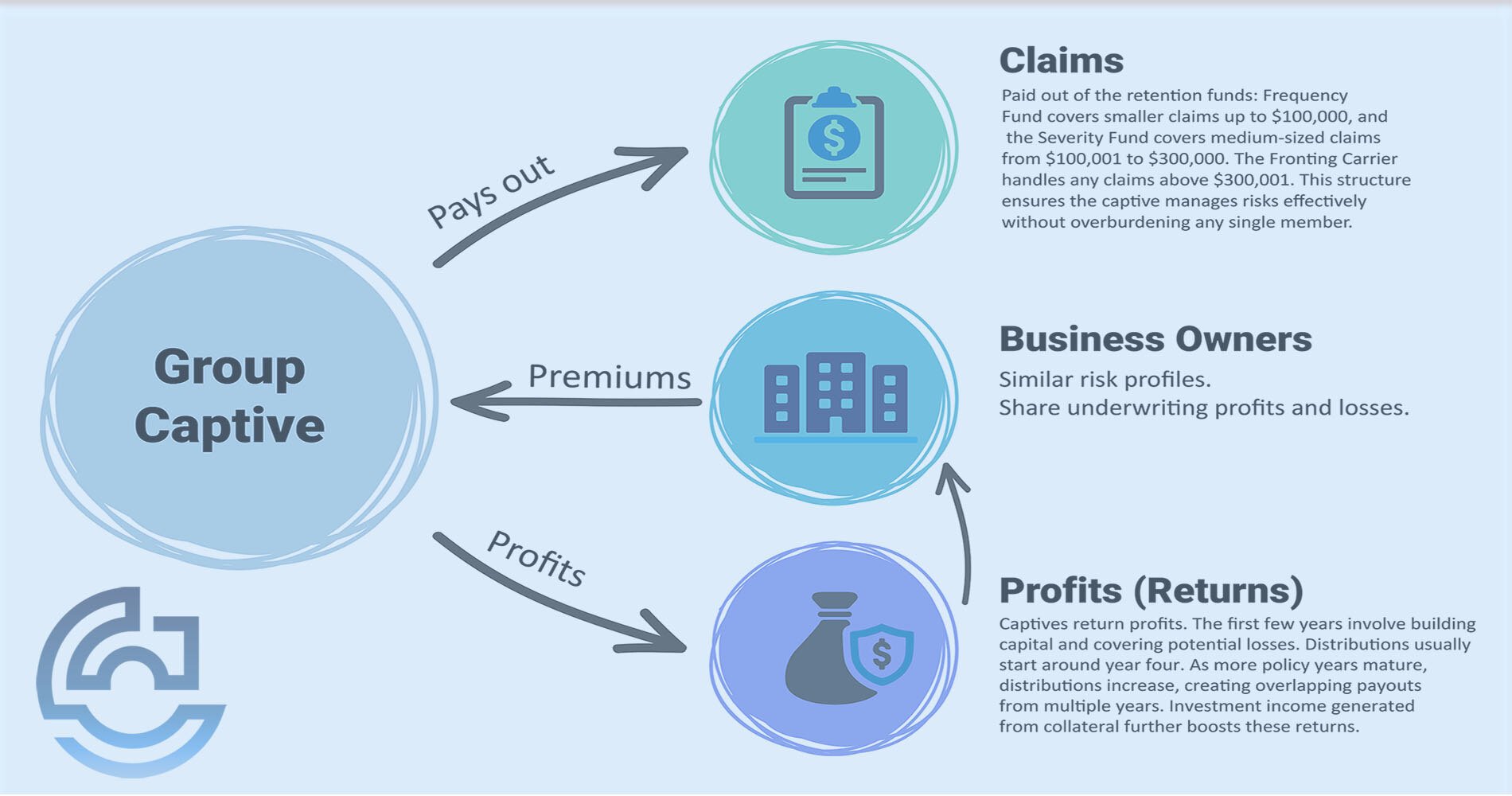

- Group Captives—These are unrelated business entities that pool their risk and share the insurance structure. While it has a collaborative approach and reduces individual risk, they have less customization and control for each participant.

Do Many Businesses Join Single-Parent Captives?

About two-thirds of all captives are single-parent captives. Given the premium (at least $1 million) needed to create one, they are very common!

Single-parent captive insurers started as an option for big companies but are now also used by smaller businesses. They are so popular because they can save money and offer more customized insurance solutions.

Benefits of Single-Parent Captives

- Control: Single-parent captives offer autonomy over risk management and insurance programs. Businesses can create insurance coverage that meets specific needs without the constraints of traditional insurance policies.

- Flexibility: These captives allow for the inclusion of a wide range of coverages, including unique risks that might not be easily insured in the traditional market. As long as the captive meets regulatory and IRS requirements, the parent company can include diverse risks such as cyber insurance, property deductibles, and more.

- Cost Efficiency: Captive owners can potentially reduce their insurance costs, especially when retaining underwriting profit and reducing claims.

- Enhanced Risk Management: Single-parent captives incentivize proactive risk management. With a direct financial stake in their insurance entity, businesses are more likely to implement robust safety and loss prevention measures.

Challenges with Single-Parent Captives

- Capital Requirements: Establishing a single-parent captive requires a substantial initial investment. Companies must adequately finance the captive to ensure its viability. The industry recommends at least $1 million be spent on premiums.

- Regulatory Oversight: Single-parent captives are subject to stringent regulatory requirements. Compliance with domicile regulations and IRS criteria is essential to maintain the captive’s legitimacy and tax benefits.

- Risk of Significant Losses: Unlike group captives, a single-parent captive assumes all risks independently. So if you have a large or many claims, it can be costly. Effective risk management and reinsurance are important to handle this.

- Managing the Captive: Running a captive can be a lot of work such as filing reports, managing finances, and claims handling. Many businesses hire a captive manager to take care of these tasks, which also adds to cost and complexity.

Operational and Regulatory Consideration

Single-parent captive operations require meeting ongoing regulatory standards and managing the captive’s financial health. This includes keeping enough reserves, processing claims on time, and following the rules of the place where the captive is set up. Brokers advising clients on single-parent captives should highlight the importance of hiring experienced captive managers and legal advisors to handle these complexities.

Are Single-Parent Captives Right for Your Clients?

Single-parent captives are great for businesses seeking more control, flexibility, and cost savings with their insurance. However, they also come with significant responsibilities and regulatory requirements. With all of this information, it is easier to see if a single-parent captive insurance company is right for your clients.

Up next, read our article on the financial advantages and disadvantages of captive insurance. This article discusses the benefits and costs businesses will need to consider, regardless of whether they choose a single-parent or group captive.

Finally, schedule a call with one of our specialists to learn more about captives and how they can benefit your clients

Topics: