Identifying Your Best Clients for a Captive Insurer:

A Guide For Independent Agents

October 9th, 2024

4 min read

When an independent agent isn’t familiar with captive insurers, it can be challenging to determine which clients are best suited for them. Much of the difficulty comes from agents lacking the confidence to bring up captives with their clients, who are concerned they may not explain it well enough. This results in shying away from what could be a viable option for their clients–especially those looking for more control and transparency over their insurance costs.

At Captive Coalition, our sole purpose is to work closely with independent agents and educate them to understand captives so that they can better serve their clients. Part of that education is helping agents identify which clients are best ready for a captive solution.

This article will teach you what makes a client a strong candidate for a captive, how to identify the indicators that suggest a captive might be right for them, and how to confidently discuss captives' advantages and potential challenges with your clients.

Why Independent Agents Hesitate Talking Captive Insurance

For many independent agents, the idea of captives is intimidating. Captives are a different insurance model, where businesses insure themselves rather than relying on traditional commercial insurance. The unfamiliarity with the captive model makes agents uncomfortable, making them reluctant to discuss it with their clients. A common fear is that they won’t be able to explain it adequately, leading to concerns about losing client trust.

One reason for this apprehension is most agents' limited exposure to captive insurance. Traditional models are more well-known, making captives feel like uncharted territory. A lack of resources and training makes independent agents feel they don’t have the knowledge to present captives as an option. However, as clients demand more control over their insurance costs, agents are interested in seeing what captive insurance offers.

Who Makes the Best Captive Clients? Three Big Indicators

When assessing whether a client is ready for a captive, three key indicators to consider are profitability to the insurance industry, risk tolerance, and a commitment to safety and risk management.

- Profitability to the Insurance Industry: A client who consistently pays more premiums than they receive in claims may be a prime candidate for a captive. If a business has a low loss ratio, meaning it’s profitable to its insurer, it could be more beneficial to be a captive owner. If clients feel they’re paying too much and not getting enough in return, they might be ready for a captive model.

- Risk Tolerance: Captives require clients to take on more risk. Whether entering a group captive or forming their own single-parent captive, businesses must be willing to bet on themselves. The client should have a mindset that values long-term stability over the short-term fluctuation they experience with traditional insurance models.

- Commitment to Safety and Risk Management: Captive clients must understand that their success hinges on how well they manage their risks. Businesses that already invest in safety programs, training, and proactive risk management are more likely to thrive in a captive. If a client’s leadership views risk management as integral to its success, it’s probably a good fit for a captive.

Client Categories: Where Captive Insurers Fit Best

Certain industries are particularly well-suited to captives. These are typically businesses with high premiums, such as construction, manufacturing, transportation, and distribution. Businesses in these sectors often face unique risks and high insurance costs, which makes them ideal candidates for captives. For instance, companies with significant auto or workers’ compensation exposures can benefit from the control and cost stability that captives offer.

Even professional services like law firms could benefit from a captive if they have enough premiums to support it. A group captive might be the best fit for smaller businesses with premiums between $250,000 and $1 million. However, larger businesses with premiums exceeding $1 million might consider forming a single-parent captive.

You might be wondering if your best clients are suitable for a captive insurer. Use this assessment tool to get those results.

The Benefits of Captive Insurance for Your Clients

As an agent, helping your clients understand the potential advantages is as essential as their challenges. Captives provide three main benefits: control, transparency, and stability.

- Control - In a captive, the client has much more control over their insurance program. Since they own the captive, they can decide how claims are managed and how their premium dollars are used. This level of control is particularly appealing to businesses frustrated with the traditional insurance market’s lack of flexibility.

- Transparency - Transparency is another major selling point. In a captive, there’s no mystery about where premium dollars go. The client can see how every dollar is spent, making it easier to understand and justify their insurance costs. This level of openness is often missing in the standard insurance market.

- Stability - In a captive, premiums are based on the client’s loss history, not the fluctuations of the broader insurance market. This predictability makes it easier for businesses to budget and plan for the future without worrying about sudden premium increases.

Client Concerns: Risk, Cost, and Long-Term Commitment

While captives offer significant benefits, clients must know about the risks, costs, and long-term commitment involved. Here are the concerns agents need to address with their clients:

- Risk - Clients may worry that a large claim will bankrupt their captive or that the captive model is too risky. It is important to explain that captives are built with safeguards, such as capped assessments and risk-sharing, to prevent catastrophic losses. Additionally, businesses that are successful in captives often already have strong risk management practices in place.

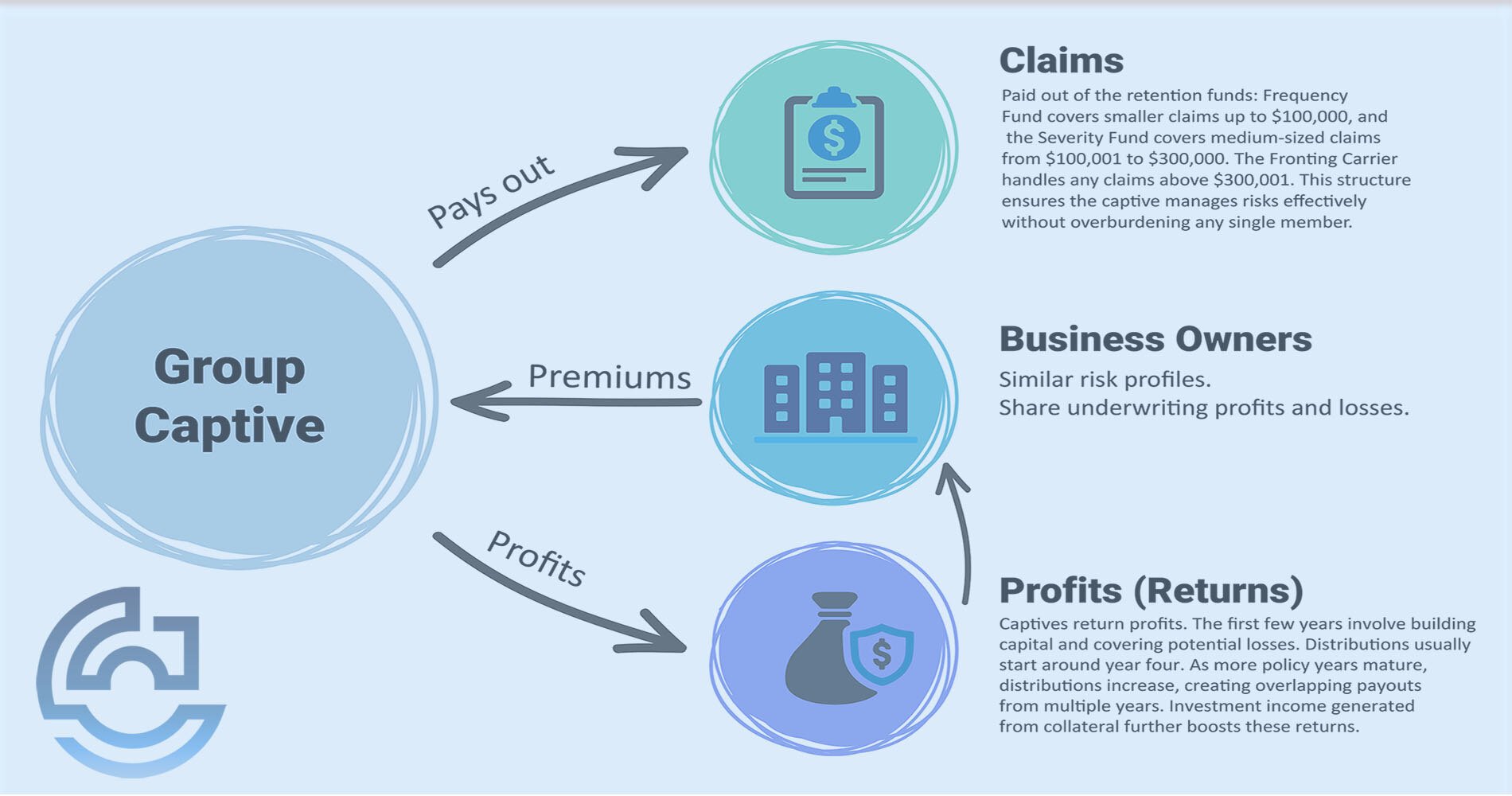

- Cost - Entering a captive does require an initial investment such as collateral (a line of credit or cash reserve used to secure claims payment), and clients may be hesitant to spend more money upfront. However, a captive's long-term savings and stability often outweigh the initial costs. It’s essential to show clients how a captive can provide long-term financial benefits, including underwriting profits and investment income.

- Long-Term Commitment - Captives are a long-term commitment, and clients need to understand that it’s not a decision to be made lightly. While they can leave a captive, doing so comes with financial consequences, such as the retention of collateral until all claims are closed. Clients hesitant about long-term decisions should be encouraged to view the captive as an investment in their business’s future, offering a decade of stability and control over their insurance costs.

Is Captive Insurance the Right Solution For Your Clients?

Determining whether your best clients are suitable for a captive starts with understanding their business, risk tolerance, and commitment to managing those risks. That way, you can help your client determine if captive insurance is the solution that fits their needs. Confidently explaining the benefits and challenges can open up new opportunities for your clients and strengthen their relationship with you.

To grow more confident in understanding captive insurance, read our Captive Insurance 101 Guide for a better general understanding of captives. And learn about the Pros and Cons of Single-Parent and Group Captives to better understand these captive models.

If you have any other questions or want to schedule a consultation, click the button below to speak with one of Captive Coalition’s captive consultants.